Listen Live

Saturday’s: 9AM 1590 AM/97.9 FM KVTA

Sunday’s: 7AM K-EARTH 101 FM

Listen Live

Saturday’s: 9AM 1590 AM/97.9 FM KVTA

Sunday’s: 7AM K-EARTH 101 FM

“The CPI news on Thursday caused the largest single-day bond rally I have ever seen in my career, as the 10-year bond yield fell a stunning 33 basis points (down to 3.81%). What was that CPI news?

“The headline rate year over year was +7.7% whereas in September it was +8.2%.

“The core rate was +6.3%, down from 6.6% the month before. This, despite energy (+1.8%) and food (+0.6%) going higher. Paradoxically, food and energy going higher was deemed a positive because the overall rate came down despite them going higher, not because of them going lower. Also, that food increase on the month was the smallest increase of the year.

“The ‘owner’s equivalent rent’ absurd contribution to inflation still caused it to move higher, not lower (by +0.6% on the month, though less than the +0.8% of last month). I say ‘absurd’ because rents are not going higher but this is taking into account leases signed a year ago (current lease levels), and is 30% of the CPI reading, so the lag effect as leases roll off month by month is severe.

“Health insurance prices were down on the month but still up 21% on the year.

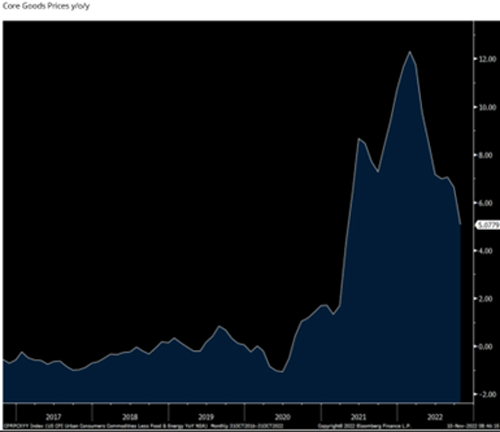

“But core prices on GOODS dropped 0.4% on the month and the yearly price dropped to 5.1% from 6% last month. Goods inflation has come down each month since I initially called a peak in goods inflation five months ago.”

Source: David Bahnsen

Looking from a different way to see inflation.

“If not for big increases in shelter (+0.8%), energy (+1.8%), and food (+0.6%), the CPI would have declined outright by 0.1%, the first dip back to deflation on this measure since May 2020.”

That’s monthly, not year over year, but certainly a good sign. We need many more such signs, though.